Our Wichita Falls Estate Planning Attorney will help you craft a plan that's right for you.

All too often, people put off thinking about those tough decisions that come with preparing for the end of life. After all, no one enjoys thinking about their death. But what’s even more difficult than thinking about such an unfortunate inevitability is thinking about what happens if you pass away without a plan in place and leave your family and loved ones struggling to pick up the pieces and administer your estate without any guidance.

If you do not plan properly and protect your assets, your family is left figuring out what assets you have, where those assets are at, what the value of those assets are, and who should get what, not to mention dealing with the probate process (that could potentially have been avoided) all during a time when they should be allowed to grieve properly without all of this unnecessary stress. Unfortunately, and way too often, we have seen families break apart after the passing of a loved one because there was no estate plan in place, and no one could agree on how the estate should be administered and assets distributed.

Not everyone’s situation is the same. Every individual has different goals, and each family has different needs. That’s why we create customized estate plans tailored specifically for you and your family. By taking the simple step of setting up a consultation with Booker Law, you can save your family from the burdens and stresses mentioned above.

What Sets Our Wichita Falls Estate Planning Attorney Apart

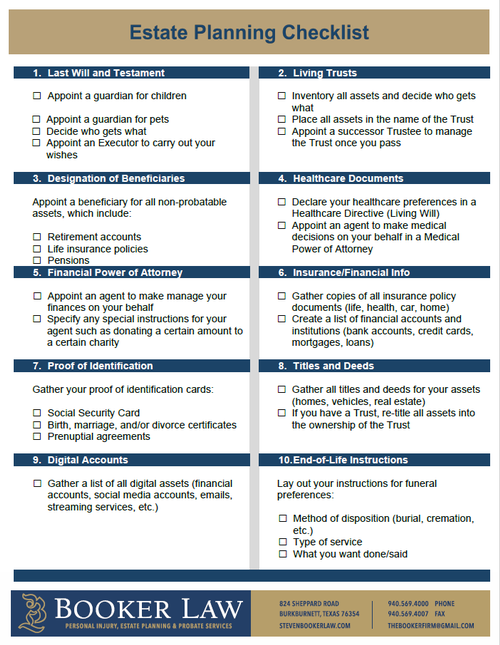

At Booker Law, we believe an effective estate plan is not merely having documents in place, but rather having a full, comprehensive plan that not only has the documents, but also leaves instructions and guidance. This is why we have created an Estate Planning Portfolio that plans for and addresses every question and scenario that could arise when you become incapacitated or pass away. In this portfolio, you will keep all of your documents in one binder along with lists of important contacts, lists of your assets, end-of-life instructions, helpful sample letters for your heirs to address various entities upon your passing, and a helpful Q&A section. This not only ensures you have everything in place, but it also makes everyone's life easier as your executors and beneficiaries will have a much easier job caring for you and administering your estate once you are gone because you have essentially provided them with a guide and instructions manual. Of course, we can still draft simple documents for you if you need to supplement an already existing estate plan. When you leave our office, you don't walk out with simple documents in hand. You leave with a full-proof plan.

What to Expect When Working With Our Team to Craft Your Perfect Estate Plan

It doesn’t matter where you are or what you do, we can tailor this process for you. Whether you prefer in-person meetings, virtual Zoom meetings, or simple telephone calls, we can accommodate you. Our process is smooth and simple. Our process goes like this:

- We send you a simple Estate Planning Questionnaire for you to fill out before your Discovery and Strategic Planning Session with the attorney. This provides us with some basic information about your family and your assets. The questionnaire is usually filled out online, but we can also mail the questionnaire to you if you prefer.

- During your Discovery and Strategic Planning Session, you will meet with the attorney to discuss your goals and the different strategies to accomplish those goals.

- We draft your estate planning documents and send them to you for review and clarification. We will explain the purpose of each document thoroughly, the decision-making powers that are outlined in each, and of course answer any questions you have.

- Finally, we set up the signing ceremony, where you will come in and finalize your estate plan.

It’s important to understand that estate planning is a never-ending process. As the changes of life happen (i.e., you have more kids, your kids grow up, your loved ones pass away, assets are sold or acquired), you need to make sure your estate plan is up to date and still reflects your wishes and desires. Once you have your initial plan established, we will follow up with you on a regular basis to ensure all necessary changes are made and adjust your plan accordingly. We will have a lifetime partnership and ensure the perfect plan is always in place for you and your family.

A Wichita Falls Estate Plan That Accounts for Everything

Will-Based Estate Planning in Wichita Falls

With our Will-based estate plan, you are getting the basics of what you need to properly accounts for your assets, appoint trusted individuals to make important decisions on your behalf, and provide you and your family with peace of mind.

Trust-Based Estate Planning in Wichita Falls

With our Trust-based estate plan, you are taking it one step further by adding on a Living Trust to the Will-based estate plan. This option allows you to accomplish all the basics while also making things easier on your loved ones when you pass by avoiding probate.

Estate Planning Modifications & Updates in Wichita Falls

Remember, as the circumstances of your life changes, so should your estate plan. It is very important to keep your plan up to date so it accurately reflects your present situation. To assist with this, we will reach out periodically as a reminder to ensure your plan is current. If any big changes have happened in your life recently, you need to come see us and make sure your plan is up to date and everything is properly accounted for.

Financial & Medical Powers of Attorney in Wichita Falls

While many estate planning documents focus on what happens when you pass away, financial and medical powers of attorney focus on arrangements for if you are ever in incapacitating circumstances and cannot make important decisions for yourself.

Estate Planning for Minor Children in Wichita Falls

I think we could all agree that our children are of the utmost importance, and it is critical to consider them in creating your estate plan, especially if they are minors. If something happens to you, you want to have a say in who raises your children.

Blended Family Estate Planning in Wichita Falls

Blended families can get complicated and unnecessary problems could arise if you don’t have a plan established. If you have a blended family, it’s important that you ensure your estate plan is arranged to account for who you want it to account for and ensure nothing is going to anyone that you do not want it to.

Special Needs Estate Planning in Wichita Falls

Like planning for minor children, special needs planning is critical in ensuring your special needs child has the proper care and proper funding to maintain that care.

.jpeg)

Key Elements of a Successful Estate Plan

Last Will and Testament

A Will is the foundation of any successful estate plan. This document, also known as a Last Will and Testament, is a legal document that allows you to establish your desires and designate exactly how your assets (your property, your money, your vehicles, etc.) will be distributed when you pass away. Through this document, you can name exactly who you want to have what, lay out your specific beneficiaries (who will receive the remainder of your estate once any specific items are given to certain individuals), appoint guardians that you want to care for your minor children, and appoint an executor who will ensure you’re your wishes are carried out and who will oversee the settling of your estate once you are gone. If you die without a valid will, the fate of your estate is put into the hands of the probate court and the state takes your place in making all the decisions about the distribution and disposition of your assets.

In summary, A Last Will and Testament allows you to:

-

Clearly define who gets what and how much.

-

Safeguard your assets from people you do not want to have them.

-

Clearly identify who you want to care for your children.

-

Ease the burden that will be put on your heirs once you pass. Your heirs will have a much faster, easier, and smoother time handling your affairs once you are gone.

-

Plan every part of how your estate is handled. You can save your estate money on taxes or you can give gifts and charitable donations, offsetting the estate tax.

Living Trusts

A Living Trust is not for everyone. In only certain circumstances do you need to have a Trust, but when your circumstances call for it, a Trust can provide you with the privacy, protection, control, and benefit you need and desire. One important advantage of a Trust as opposed to a Will, is the ability to make assets available more quickly. This timely distribution of assets is accomplished because Living Trusts do not have to go through Probate, which all Wills are required to go through. Additionally, because Wills must go through Probate, they become public documents whereas Trusts can remain completely private. The assets included in the Trust may be distributed upon your death or immediately upon your disability or incapacitation.

Financial Power of Attorney

A Financial Power of Attorney is another important document often utilized in creating and devising estate plans. Through this document, you can assign someone, an Agent, to act on your behalf regarding financial matters. Financial Power of Attorneys are only active when you choose for them to be, which may be while you are well and/or only if you become incapacitated. Additionally, you have the ability to decide exactly what financial matters you want your agent to be responsible. This responsibility could include everything, or it may be limited to specific financial obligations.

You May Want to Utilize a Financial Power of Attorney if:

-

You want to appoint someone to manage your financial matters if/when you become incapacitated.

-

You want to appoint someone to manage your financial matters now.

Healthcare Directive

An essential part of any estate plan is a Healthcare Directive, sometimes referred to as an Advance Directive or Directive to Physicians. This document allows you to make important end-of-life decisions about your personal healthcare, which is extremely important because you won’t to have those wishes laid out, so that burden doesn’t fall on your loved ones. It’s crucial to have this document in place because if, at some point, you fall into a coma or otherwise become incapacitated, you may not be able to verbalize these wishes. A Healthcare Directive is an effective way to ensure your wishes are on record for your loved ones as well as your health care provider.

Medical Power of Attorney

A Medical Power of Attorney, also called a Healthcare Power of Attorney, is used to appoint a person to make medical choices for you should you ever become incapacitated and unable to make your own decisions. This person, called your Agent, will be able to make choices for you such as whether you should be admitted into a care facility, what treatments you'll receive, whether or not you'll receive experimental treatments, or if your medical providers have permission to connect you to live sustaining equipment in order to keep you alive.

A Medical Power of Attorney is used to appoint a person to make medical choices for you should you ever become incapacitated and unable to make decisions on your own, decisions such as:

-

Whether or not you should be admitted to a care facility

-

Whether you'll receive experimental treatments

-

If medical providers will be allowed to connect you to machines to keep you alive.

HIPAA Authorization

HIPAA Authorizations and Release Forms allow you to give permission to and provide others with access to your medical records, which are otherwise protected through HIPAA. This is most often used to provide other healthcare providers or doctors with this access. However, with this form, you can also allow for the release of your medical information to a specific, identified person.

Giving individuals permission to view your medical records is sometimes necessary. By providing whoever you choose with access to your health information, you empower them to make more informed decisions regarding your health while maintaining control of exactly who has access to this information.

Other Helpful Estate Planning Documents for Texas and Oklahoma

Deeds

Most owners of real estate have two important goals:

-

Retain as much ownership and control over the property as possible while they are alive.

-

Easily pass the property to a family members or other designated beneficiaries at death with the least amount of expense and hassle.

Some states laws provide several ways to accomplish these goals. A Living Trust is one option, however, it is the most expensive and much more complex to complete and maintain. For property owners looking for a less expensive and simpler option, depending on the state they’re in, the law may recognize several types of probate avoidance deeds. Two effective probate avoidance deeds are Transfer-On-Death Deeds (TOD Deeds) and Lady Bird Deeds, also referred to as Enhanced Life Estate Deeds.

Transfer on Death Deeds (Texas and Oklahoma)

Transfer on Death Deeds are an easy and effective way to transfer real estate upon your death. Essentially, a Transfer on Death Deed is like any other regular deed that is used to transfer ownership of real estate. However, the difference is that this type of deed doesn’t take effect until you pass away.

How this type of deed works is you name one or more beneficiaries who you want to inherit your property upon your death. While you are alive, you maintain complete ownership and control of the property. You are responsible for paying the taxes, and you maintain the right to sell it, rent it, or do whatever you want to do with it. The property only passes ownership to who you named once you pass away.

The advantage of a Transfer on Death Deed is that they are easy to create and you can revoke it or change it at any time. Additionally, it is a way to avoid probate, thereby saving time and money, and getting the property into the beneficiary’s name quicker and easier.

One stipulation of a Transfer on Death Deed is that the interest in the property is subject to claims filed against the probate estate for two years once the grantor has passed. Additionally, the beneficiary must survive the grantor by 120 hours in order to inherit the property. If the beneficiary dies before the grantor or within those 120 hours, the interest in the property must pass through the grantor’s estate.

Lady Bird Deeds, or Enhanced Life Estate Deed (Texas)

Lady Bird Deeds are similar to Transfer on Death Deeds. Owners of real estate can transfer the real estate to another person upon their death. While the grantor is still alive, they maintain completed control of the property and can do whatever they want with it. The grantor retains the ability to lease, mortgage, or sell the property and the grantor also retains the right to retain any proceeds generated from the property. Additionally, if the grantor wishes to terminate the transfer, they can do so at any time.

But with Lady Bird Deeds, a Power of Attorney can sign on behalf of the grantor. So, if an agent for the property owner has a Power of Attorney, they can sign a Ladybird Deed even if the property owner lacks the mental capacity to sign a legal document.

Why You Need a Proper Estate Plan

Estate planning is mapping out and deciding what happens to you and all of your possessions if at any point you become incapacitated or you pass away. Why should your lifetime of hard work go to waste or go to someone you don't intend for it to? Estate planning means protecting yourself, your assets, and your family.

Common goals of estate planning:

-

Keep control of your property

-

Protect yourself and your family

-

Get your assets to the people you want without any unnecessary costs

The more planning you do now, the less burden you place on those you leave behind.

The Booker Law Estate Planning Portfolio Binder

All our package deals come with an “Estate Planning Portfolio”. In this portfolio, you will have your estate plan neatly tabbed and organized along with the additional helpful sections provided for you to fill out and maintain organization of your estate for the convenience of your family. We also understand the importance of having digital copies in this day and age, so we provide you with those digital copies on a USB drive.

In addition to having all your estate planning documents neatly organized and together, you will be provided with the following:

-

Essential Documents: This section allows you to keep track of personal information, contact information for family members and for any other important persons or agencies as well as where all your important documents are.

-

Assets: This section allows you to keep track of all your assets for the ease and convenience of your family. Much of the burden in estate administration comes from tracking down and locating all assets. By maintaining a list of your assets within your estate planning portfolio binder you are making life much easier for your loved ones.

-

End-of-Life Instructions: This section provides a checklist of things to do upon your passing and it provides a basic template of things to do and letters to send to notify certain agencies of your passing.

-

Q&A and Glossary: This section provides answers to the most frequently asked questions about estate planning, and it defines some common estate planning terms.

-

Blank Sections: We provide blank sections for you to fill in as you see fit. If there are any type of instructions or information we have not accounted for in the above sections, this is where you would add those in.

Booker Law’s Estate Planning System

-

Estate Planning Questionnaire: Quick and easy way for us to get a good understanding of your unique situation.

-

Discovery and Strategic Planning Session: Understand your option and select the estate planning solution that is right for you.

-

Signing Meeting: Review and sign your estate plan.

-

Estate Plan Maintenance and Client Care: Enjoy calls, emails, and review meetings with our firm to make sure your plan remains up to date and accurately reflects your current circumstances.

We will be here for you as a trusted family attorney and counselor.

Estate Plan Maintenance and Client Care

As a client of ours, we encourage you to take advantage of the services we offer in support of estate plan maintenance and client care.

Our services go far beyond simply setting up a Will or Living Trust. Our team and our resources are also available through:

-

Free phone calls.

-

Helpful videos

-

Informative articles

The Cost of a Customized Estate Plan is Invaluable

All our estate plans are prepared for a fixed price quoted in advance at the discovery meeting and agreed to by you in writing before we finalize your plan. There will not be any surprise changes or fees ever. Additionally, payment plans are available if needed. We welcome the opportunity to serve those vital to our communities, including teachers, military service members, and first responders.

In the end, you will walk away with a comprehensive, customized estate plan tailored specifically to meet yours and your family’s needs. But more importantly, you walk away with the peace of mind knowing your affairs are in order and your family is provided for.

Contact a Wichita Falls Estate Planning Attorney

At Booker Law, our desire is for our clients to understand all their options and make an educated decision.

You need to protect your loved ones from these outcomes by having a Will-based estate plan in place.

Do not delay. Plan for the inevitable and secure your family's future. Call us at 940-569-4000 or fill out our contact form to schedule a free, confidential, no-obligation consultation.