The majority of people don’t realize the importance of proper estate planning. It is extremely critical not only to protect yourself and the things you’ve worked for your whole life, but it is also for your family’s benefit.

Unfortunately, most people don’t see this as such a priority. In fact, only about 4 out of 10 Americans have a Will or Living Trust in place. The reason?

Most people simply say they just, “haven’t gotten around to it” while others claim they, “don’t have enough assets to leave anyone.”

Planning for our death or incapacitation is not on the top of our to-do lists. We tend to live our lives with the hope that we will not die anytime soon. However, we know that life is challenging and uncertain. We just don’t know what each day will bring.

This why good estate planning will give you the peace of mind you need knowing that yourself and your loved ones will be properly provided for. Whether you have a large or small estate, you need to be sure that your wishes are followed upon your death or incapacitation.

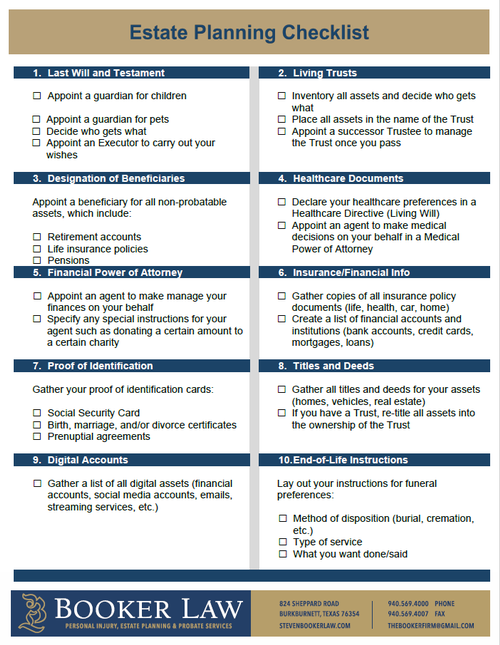

Estate planning can be broken down like this. First, it is your assets such as your home, vehicles, life insurance policies, and retirement plans. Second, it is choosing the estate planning tools that will help you preserve and manage those assets upon your disability or incapacitation, and Third, it is choosing the estate planning tools that will distribute those assets as you see fit when you are no longer around.

There are various estate planning tools that we can prepare to help you reach your goals, such as a Will, Trust, medical power of attorney, durable power attorney, and a health care directive to your physician.

It is pretty straight forward, however, there are some challenges that must be taken into consideration and those challenges are probate, death taxes, and guardianship.

As you can imagine, there are a lot of misconceptions about estate planning and because of these misconceptions, a lot of people don’t realize the tremendous benefits that come about because of it.

Having a plan in place can lift an enormous burden off of you and your loved ones.

If you want to learn more about estate planning you can call or email and request our free Estate Planning Checklist or if you are interested in getting started with your estate planning, call us today at 940-569-4000 to set up a free consultation.